But they also give a business other advantages, such as permitting a single trial balance to be extracted from the general ledger. If the trial balance does not actually balance, only the accounts whose control account does not reconcile need to be checked for errors. The fundamental purpose of a control account is to aid in the detection of mistakes in subsidiary ledgers. However, they also provide additional benefits to a company, such as the ability to extract a single trial balance from the general ledger. Only the accounts whose control account does not reconcile need to be examined for mistakes if the trial balance does not balance.

The general ledger account that sums the subsidiary accounts is said to control the balances that are reported in the ledger. This makes sense because the subsidiary accounts are not directly reported in the GL. They are summarized and posted to the control account that in turn appears in the GL.

How is a Control Account Used?

The factor pays upfront for the receivables and then collects them from the original debtor in exchange for a small fee. This saves companies the need to wait 30 to 90 days to get capital, preserving their cash flow and allowing them to meet their obligations on time or seize new business opportunities. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. In the creditor’s ledger, the monthly recordings are distinguished using a number line, while the individual creditors are differentiated using several categories of digits such as 1 to 10. A different person can maintain the control account as a preventive measure against fraud.

Ch. 11 Ruling Informs on Social Media Ownership Rights – Troutman Pepper

Ch. 11 Ruling Informs on Social Media Ownership Rights.

Posted: Fri, 28 Jul 2023 00:00:00 GMT [source]

Control accounting both helps produce clean financial reports, and provides checks and balances for accurate reconciliation. In the case of an accounts receivable control account, the subtotal of the customer balances in the subledger must match up to the control account. If it does not, then there is an error somewhere in the books that must be corrected. While subsidiary accounts are critical for recording a company’s transactions, control accounts allow for high-level analysis by simply focusing on the balances of each account. They are especially important for reconciliation in large companies with a high volume of transactions when only the balance of the account is needed.

Free Bookkeeping Accounting

Maintaining the individual entries for every individual account is an ideal accounting practice. A creditors control account acts as the holding account of purchased credit notes and invoices before they are deposited in the bank account. Once you have a good understanding of debits and credits and the basics of double-entry bookkeeping, then you may be ready to understand and start using the definition and calculation of federal income tax. If you are still new to bookkeeping and accounting, I suggest you take my free bookkeeping course.

In this way, the controlling account really does dictate what appears in the GL and what is reported on the financial statements. The types of control accounts include debtors control accounts, creditors control accounts, and stock control accounts. These forms of control accounts are used to summarize the business within the general ledger. A control account for her business is the general ledger account entitled Accounts Receivable. Typically, this includes total credit sales for a day, total collections from customers for a day, total returns and allowances for a day, and the total amount owed by all customers.

Debit the office expense or stationery expense account and credit the company bank account. When you account for any financial transaction of a business, company, or other entity, you always need a debit entry and a corresponding credit entry… Listing each debtor account individual account would clutter a general ledger, so those accounts could be listed in a subledger and consolidated in a control account. Imagine your trial balance or balance sheet with hundreds of transactions appearing on it.

Post navigation

A control account refers to a summary of accounts in the general ledger of a business that assists in streamlining detailed transactions in a balance. A control account is essential during the preparation of financial statements in various corporations. It also frees the general ledger from lots of details, and it is mainly applied for accounts payable and receivable. A control account is used to ensure equality between the general ledger and the subsidiary ledger. A general ledger involves a record of the entire past transactions in the business.

If more information is needed for a specific customer, the subsidiary accounts and records can always be reviewed. As you can see, control accounts drastically clean up the ledger and make it easier for accountants and bookkeepers to use. A debtors control account utilizes the principle of double-entry because both the debit and credit transactions are recorded. Sums paid by debtors and the sum of credits realized within the business are recorded. The examples above are very basic and are standard double-entry accounting transactions.

AccountingTools

A small business may generally record all of its transactions in the general ledger, eliminating the requirement for a control account-linked subsidiary ledger. Control accounts work as a summary account, presenting the balance of the subsidiary accounts without including the transaction details. Companies using a control account typically post balances from the subsidiary ledgers daily to make sure that they’re always in balance. However, if you’re still using a manual ledger system, the purpose of control accounts is to take the balance of the accounts in the subsidiary ledgers and post the total into the general ledger.

- It would not be posted to the bank account as no physical cash has gone to the bank account, or the petty cash account…

- In this way, the controlling account really does dictate what appears in the GL and what is reported on the financial statements.

- Since both are zero and match, it would not be necessary to prepare a schedule of accounts payable.

- A small organization can typically store all of its transactions in the general ledger, and so does not need a subsidiary ledger that is linked to a control account.

- Later, Einstein documents total purchases within the master ledger by crediting the transaction in the payable control account and debiting the transaction in the purchases account.

- Following this method assists management in establishing a control over ledger posting, therefore reducing the risk of misrepresentation and fraud.

He also assesses whether the total amount in the control account equates with the amount in the individual supplier account to balance the transaction within the subsidiary ledger. A company can have hundreds or thousands of customers with current accounts receivable balances. The total of all of these accounts is carried forward into the A/R control account, which appears in the general ledger and the financial statements. For example, all payables entered during one day will be aggregated from the subsidiary ledger and posted as a single summary-level number into the accounts payable control account. The definition of a control account is a general ledger account that summarizes (or controls) a subsidiary ledger group of detail accounts.

In the wake of the COVID-19 pandemic and escalating tensions with China, American companies are actively seeking alternatives to mitigate their supply chain risks and reduce dependence on Chinese manufacturing. Nearshoring, the process of relocating operations closer to home, has emerged as an explosive opportunity for American and Mexican companies to collaborate like never before. About the Author – Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers. We strongly advise you seek the advice of accounting and tax professionals before making any accounting related decisions.

Personal finance hacks 101 – Inside INdiana Business – Inside INdiana Business

Personal finance hacks 101 – Inside INdiana Business.

Posted: Mon, 31 Jul 2023 10:00:00 GMT [source]

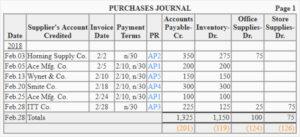

Let’s consider a hypothetical example of a small business that uses control accounts and subsidiary ledgers to manage its accounts receivable. For example, if you post a batch sales invoice, you only need to enter one sales nominal code but the debtors control account and sales tax control account are updated automatically. This section will look at the transactions for Fooz Ball Town and how to post to subsidiary ledgers for accounts receivable and accounts payable.

A control account is a general ledger account containing only summary amounts. The details for each control account will be found in a related (but separate) subsidiary ledger. With the double-entry accounting system, accounts receivable, and accounts payable are the common types of control accounts. For credit purchases, the control account is often referred to as the purchase ledger or purchase ledger control account (PLCA). A control account will help identify what is outstanding – what is owed to the business (asset) and what the business owes (liability). Controls accounts also allow you to record both sides of an accounting transaction (the debit and the credit).

If the balance does not match, it is possible that a journal entry was made to the control account that was not also made in the subsidiary ledger. Different sales accounts offer a summary of business transactions integrated within the general ledger. The debtors control account contains the sales journal and the total amount of payment owed by the debtors in the company. Also, businesses with many creditors should adopt maintaining the individual entries by placing totals within the creditors control account. A creditors control account refers to a ledger account that indicates the sum of the creditors’ transactions within the master ledger. On the other hand, a stock control account depicts the total value of the stock items.

This site contains information on double-entry bookkeeping, basic accounting, credit control, business planning, etc. The Control Accounts list shows the nominal accounts that are classed as control accounts. The list can’t be increased or reduced and the labels for the accounts can’t be changed. Control accounts are the nominal accounts that help to ensure the correct automatic postings are made by the software. They ensure that the accounts always balance and they are the default accounts to be used in a variety of circumstances.

Please watch the video below to gain a much better understanding of control accounts. That is what double-entry bookkeeping is – accounting for transactions that have happened within a business or company. If you’re interested in finding out more about control accounts, then get in touch with the financial experts at GoCardless. Find out how GoCardless can help you with Ad hoc payments or recurring payments. However, if Taylor or anyone else wants to find out the amount that a specific customer still owes for their credit purchases, or when they bought the item, that won’t be shown in the control account. Accounts receivable are created when a business extends credit to its customers.