This is capital that is seen as being of a higher risk than its Tier 1 core capital partners. The capital that falls within the definition of Tier 2 is revaluation reserve, undisclosed reserves, and subordinate debt. Revaluation reserve is capital earned when the revaluation of an asset leads to it gaining value compared to its previously determined value.

Royal London deal shows appetite still there for tier-1 – Euromoney magazine

Royal London deal shows appetite still there for tier-1.

Posted: Wed, 31 May 2023 07:00:00 GMT [source]

It is estimated that over 90% of the capital raised to date via Regulation A was done so via Tier 2. Tier 1 has only accounted for roughly 5-10% of the total capital raised and I would expect that percentage to shrink even further as Regulation A grows in popularity. With Tier 1, no upfront financial audit is required by the SEC, but it is important to note that many individual states will require this.

What is the difference between Tier 1 and Tier 2 Reg A+ offerings?

While violations of the Basel Accords bring no legal ramifications, members are responsible for the implementation of the accords in their home countries. This means that, if a bank fails, its Tier 2 assets will absorb any losses before its creditors or depositors do. This ensures that the funds are sufficiently liquid and are available when the bank needs to use them. These funds are generated specifically to support banks when losses are absorbed so that regular business functions do not have to be shut down. [6] An Enterprise may disregard de minimis assets related to the operation of the issuing entity for purposes of this criterion. [3] De minimis assets related to the operation of the issuing entity can be disregarded for purposes of this criterion.

- Since Tier 1 Capital is more important, banks are also required to have a minimum amount of this type of capital.

- Asset classes that are safe, such as government debt, have a risk weighting close to 0%.

- In addition, an instrument issued by an Enterprise to its employee stock ownership plan does not violate the criteria in paragraphs (c)(1)(v) or (c)(1)(xi) of this section.

- In addition, tier 2 capital incorporates general loan-loss reserves and undisclosed reserves.

A current revaluation is likely to reflect a large increase in value. The reserve may arise out of a formal revaluation carried through to the bank’s balance sheet, or a notional addition due to holding securities in the balance sheet valued at historic cost. Basel II also requires that the difference between the historic cost and the actual value be discounted by 55% when using these reserves to calculate Tier 2 capital. Under Basel III, the minimum tier 1 capital ratio is 10.5%, which is calculated by dividing the bank’s tier 1 capital by its total risk-weighted assets (RWA). RWA measures a bank’s exposure to credit risk from the loans it underwrites. The Accords set the capital adequacy ratio (CAR) to define these holdings for banks.

Reg A Marketing

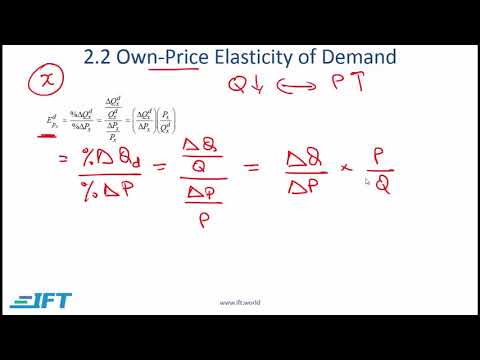

Risk-weighted assets are the assets held by the bank that are weighted by the credit risk. The formula is Tier 2 capital divided by risk-weighted assets multiplied by 100 to get the final percentage. The acceptable amount of Tier 2 capital held by a bank is at least 2%, where the required percentage for Tier 1 capital is 6%.

Banking regulations known as the Basel Accords require banks to have different types of capital on hand. These liquid and cash assets balance out the risk-weighted assets that banks hold. This increases banks’ stability, which increases the stability of the overall financial system. The Capital Adequacy Ratio set standards for banks by looking at a bank’s ability to pay liabilities, and respond to credit risks and operational risks. A bank that has a good CAR has enough capital to absorb potential losses. Thus, it has less risk of becoming insolvent and losing depositors’ money.

CA-2.5 CA-2.5 Minimum capital ratio requirement

We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests. However, this advantage often falls by the wayside because the many US States require audited financials for Tier 1 to satisfy their process.

This takes care of the time to maturity problem for Tier 2 subordinated debt. The Basel Committee also observed that banks have used innovative instruments over the years to generate Tier 1 capital; difference between tier 1 and tier 2 capital these are subject to stringent conditions and are limited to a maximum of 15% of total Tier 1 capital. This part of the Tier 1 capital will be phased out during the implementation of Basel III.

Maximum Offering Duration

California, for example, applies Merit Review in which the State decides if a company offering is a low enough risk for their residents. One securities attorney that completed a Tier 1 offering that filed in almost all US States told me she would never do it again because it was so slow and expensive to get through the States processes. This site lists the State by State filing requirements so you can check your States out. Under Basel III, the bank met the minimum total capital ratio of 12.9%. Under Basel III, the minimum total capital ratio is 12.9%, which indicates the minimum tier 2 capital ratio is 2%, as opposed to 10.9% for the tier 1 capital ratio.

What is Tier and tier 2?

Tier 1 and Tier 2 NPS accounts are two different categories. As opposed to Tier 1, which serves as the principal NPS account for building a retirement fund, Tier 2 is similar to a voluntary savings account and provides greater flexibility for deposits and withdrawals.

What is Tier 1 and tier 2 and Tier 3 capital?

A bank's total capital is calculated as a sum of its tier 1 and tier 2 capital. Regulators use the capital ratio to determine and rank a bank's capital adequacy. Tier 3 capital consists of subordinated debt to cover market risk from trading activities.